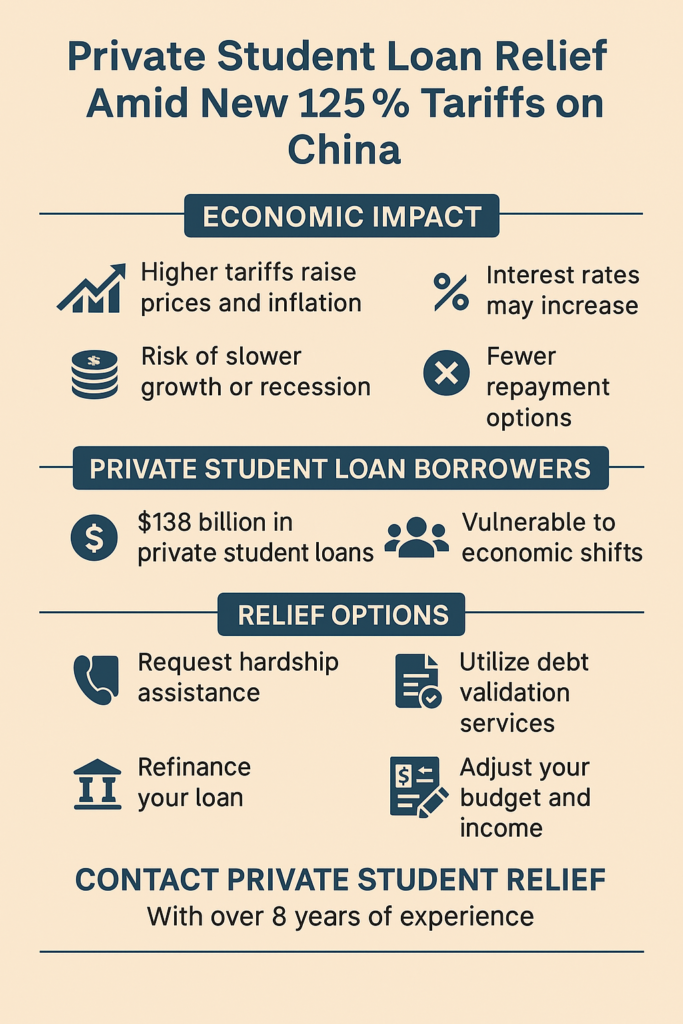

The United States has recently ratcheted up tariffs on Chinese imports to a staggering 125%, marking a dramatic escalation in the trade tensions between the world’s two largest economies. Such a steep tariff hike is not just a headline about international trade – it’s a development that may hit home for American consumers and borrowers. In particular, people dealing with private student loan debt can be especially vulnerable to economic shifts like these new tariffs. In this in-depth article, we’ll explore how the tariff surge is affecting the U.S. economy and why private student loan relief has become a focal point in this context. We’ll dive into recent statistics, understand the challenges faced by borrowers (including physicians and other professionals with hefty private loans), and discuss what steps can be taken – from refinancing to debt validation – to navigate these turbulent times. By the end, you’ll see why staying informed and proactive is crucial, and how specialized services like Private Student Relief (a company with over 8 years of experience in private student loan debt validation) can help borrowers regain control.

Understanding the 125% Tariffs and Their Economic Impact

In early 2025, the U.S. dramatically increased tariffs on Chinese goods to 125% – meaning importers must pay an extra amount equal to 125% of the product’s value in duties. This move came after tit-for-tat escalations (China had raised its tariffs on U.S. goods to 84% in retaliation) and was justified by U.S. officials as a response to perceived unfair trade practices. But what does this mean for the U.S. economy and everyday Americans?

Tariffs, Prices, and Inflation

Tariffs are essentially a tax on imported goods. When tariffs soar, the cost of those goods to U.S. businesses and consumers also rises. Indeed, Federal Reserve Chair Jerome Powell noted that Trump’s tariffs are likely to increase inflation and slow economic growth. In practical terms, American shoppers could see higher price tags on a wide range of products – from electronics and clothing to everyday groceries and cars. The inflationary effect of tariffs occurs because importers often pass on the added cost to consumers. Powell cautioned that while the inflation spike from tariffs might be “temporary,” there is a real risk that the effects could be more persistent if the trade war drags on with no resolution. In short, tariffs are “simply inflationary,” as one economist put it, and the 125% rate all but guarantees noticeable price hikes for American households.

Higher prices erode consumers’ purchasing power. For someone already stretching their paycheck to cover living expenses and student loan payments, an uptick in prices due to tariffs can strain their budget further. Everyday essentials costing even 5-10% more adds up quickly, effectively leaving less money available to pay down debts like private student loans. It’s no surprise that analysts are warning of inflation climbing in the wake of these tariffs and the need for careful monitoring by the Federal Reserve.

Tariffs and the Risk of Slower Growth or Recession

Beyond prices, tariffs can also impact jobs and economic growth. By making imports more expensive, tariffs can disrupt supply chains and increase costs for U.S. manufacturers who rely on Chinese components. This often leads to reduced production or investment. In this case, the trade war escalation has economists sounding alarms: former Treasury Secretary Larry Summers warned that the U.S. is increasingly likely to slip into recession due to the escalating tariffs, potentially costing 2 million jobs nationwide. Such job loss projections highlight the stakes – if companies scale back or lay off workers to offset higher costs, unemployment could rise.

Even if a full recession is avoided, growth is expected to take a hit. Businesses facing higher input costs may hire fewer people or freeze pay, and foreign trading partners might retaliate further (for example, by buying less from U.S. exporters like farmers and aircraft makers). In fact, U.S. exports to China were about $199 billion in 2024, and any decline in that due to Chinese retaliation could hurt industries from agriculture to aerospace. The bottom line is a less robust economy, which means fewer new job opportunities and weaker wage growth for workers.

For borrowers – especially those with significant private student loan debt – an economic slowdown is double trouble. Not only might finding or keeping a well-paying job become harder, but one’s dollars don’t stretch as far because of the aforementioned inflation. This scenario, sometimes dubbed “stagflation” (stagnant growth + inflation), squeezes households from both sides. Private student loan relief becomes even more critical in such times, as borrowers look for ways to stay afloat financially.

Rising Interest Rates and Borrowing Costs

Another ripple effect of tariff-induced inflation is its influence on interest rates. The Federal Reserve’s mandate is to control inflation and support employment. If tariffs push inflation higher, the Fed might respond by keeping interest rates elevated longer or even raising them further to cool down prices. In fact, Federal Reserve officials have explicitly flagged that higher tariffs pose a risk of “more persistent” inflation, which could complicate their interest rate decisions.

We are already in an environment of higher interest rates compared to a few years ago, and the trade war news has added pressure. Following the announcement of the 125% China-specific tariff, the 10-year Treasury yield climbed, driving up long-term interest rates. For example, the 30-year fixed mortgage rate jumped to about 7% (up 0.27 percentage points in just a week) after the tariff news shook markets. This is a telling sign: when investors expect more inflation or more risk, they demand higher yields, which in turn raises rates on consumer loans.

What does this mean for student loan borrowers? Many private student loans have interest rates that are tied to market rates (often a variable rate indexed to the Prime rate or LIBOR/SOFR). As general interest rates rise, new private loans become more expensive and existing variable-rate loan payments can increase. Even fixed-rate private loans aren’t directly affected in the short term, but anyone looking to refinance or needing a new loan for graduate school, for example, will face higher rates. Inflation and high rates are a bad combo for borrowers: not only are your expenses higher, but the cost of borrowing (or refinancing) money is higher too. According to financial experts, periods of high inflation make it harder to repay existing debt and tend to drive up rates on private student loans as well. In other words, borrowers with private loans might see no relief in their interest costs; if anything, they could end up paying more interest than they anticipated when they first took out the loans.

Private Student Loan Borrowers in an Uncertain Economy

So, how does all of this economic turbulence connect to private student loan relief? To answer that, we need to look at the situation of private loan borrowers and why they’re uniquely at risk when the economy jolts.

First, let’s clarify the landscape of student debt. Americans owe around $1.77 trillion in student loans in total, an enormous figure that has steadily climbed over the years. The vast majority of this debt (over 92%) is made up of federal student loans, which come with government-set terms and protections. However, about 7.8% of all student loan debt – roughly $138 to $140 billion – is private student loans. These private loans are taken out from banks, credit unions, or other private lenders, often to cover education costs beyond federal loan limits or to refinance existing loans. Millions of Americans carry private student loans, and these loans often look very different from their federal counterparts in terms of interest rates and relief options.

Why Private Loan Borrowers Are Vulnerable to Economic Shifts

Borrowers with private student loans are particularly exposed during economic downturns or periods of rising prices. The reason is twofold: higher financial strain and fewer safety nets.

Higher financial strain: As discussed, tariffs and inflation drive up the cost of living. If you’re a private loan borrower, you likely have a significant monthly payment due regardless of your income situation – private loans typically do not offer income-driven repayment plans. When your grocery bill, gas bill, and other expenses increase, it directly affects how much money you have available to cover that student loan payment. Unlike some federal loans, which were on pause during COVID or can be reduced via income-based plans, private loan payments must be met each month or you risk default. Essentially, the budget squeeze gets tighter. A recent survey highlighted that inflation and the resumption of student loan payments are major stressors for Americans’ finances. With inflation high, “millions will struggle to repay student loan debt” if their incomes don’t keep up – and this struggle is even more acute for private loan holders who generally have higher interest costs and no payment suspension option.

Fewer safety nets: One of the biggest differences between federal and private student loans is the availability of relief measures when hardship hits. Federal student loans have built-in protections – for instance, if you lose your job or face financial hardship, you can apply for forbearance or deferment, and interest may not accrue on subsidized loans during deferment. There are also income-driven repayment (IDR) plans that can drop your payment to as low as $0 if your income is low enough, and potential loan forgiveness after 20-25 years or through programs like Public Service Loan Forgiveness. Private student loans, on the other hand, don’t generally offer such robust relief options. According to the Student Borrower Protection Center, private student loans contain fewer safeguards to help mitigate default when borrowers face economic hardship Most private lenders are not required to offer income-based payments or any forgiveness programs. At best, they might offer a temporary forbearance or modified payment plan, but interest usually continues accruing during those periods. In fact, during the COVID-19 pandemic, when federal loans were put on a long administrative forbearance (0% interest, no payments required for over three years), borrowers with private student loans were largely left without relief – they were “haven’t been so lucky” and had to keep paying or seek help on a case-by-case basis. This stark contrast showed how vulnerable private loan borrowers are to sudden economic crises.

Co-signer implications: Many private student loans are co-signed by a parent or other family member (a necessity for younger borrowers who lack credit history). In fact, about 88–93% of private student loans have co-signers obligated on the debt. This means economic pain can spread across the household – if a borrower can’t pay, the co-signer is on the hook. In an economic downturn induced by something like high tariffs, if the primary borrower or the co-signer loses income, both could face the loan default together. And unlike federal loans which are generally dischargeable if the borrower dies, private loans may pursue co-signers for repayment in such tragic cases. Economic stress can thus put not just students but their families at risk financially.

Higher interest and less flexibility: Private loans often carry higher interest rates than federal loans (especially older private loans or those taken by borrowers with moderate credit). With the current trend of rising interest rates, some private loan borrowers with variable rates have already seen their rates climb, increasing their monthly payment. Unlike federal fixed rates, these variable private rates respond to the Fed’s moves – and the Fed, in trying to counteract tariff-related inflation, may keep rates elevated. Moreover, private lenders can be more rigid; for example, default on a private loan can occur after just 90 days of non-payment in some cases (versus 270 days for federal loans). Once in default, a private loan can swiftly be sent to collections or even court, with fewer avenues to “rehabilitate” the loan compared to federal. All of this makes private student loan borrowers extremely sensitive to economic headwinds – they have more to lose and fewer lifelines.

Given these challenges, it’s clear why talk of private student loan relief has gained urgency. When the economy is strong, borrowers might manage okay; but when inflation surges and growth falters, these loans can become a heavy albatross. Next, let’s look at some numbers and relief strategies in detail, and how borrowers can seek help.

By the Numbers: Student Loan Debt and Economic Pressure

To fully grasp the situation, it’s helpful to look at some recent statistics side-by-side – both on the tariff impact and on student loan debt. The table below summarizes key indicators:

Table 1: Tariffs and Economic Impact Indicators

| Indicator | Pre-Tariff Escalation (late 2024) | Post 125% Tariff Outlook (2025) |

|---|---|---|

| Tariff rate on Chinese imports | 25% (on many goods) + 104% on select categories | 125% on virtually all imports from China |

| Consumer Price Inflation (annual) | ~2.4% (eased by early 2025) | Rising pressure, Fed warns of persistent effects. Prices of many goods expected to jump. |

| 10-Year Treasury Yield | ~3.8% (avg 2024) | Higher – investors demand more yield. Spiked above 4% after tariff news, pushing mortgage rates ~7%. |

| Federal Reserve policy stance | Pausing rate hikes as inflation cooled | On alert – tariffs are “highly likely” to cause an inflation uptick. Potential delay in any rate cuts. |

| U.S. GDP Growth | ~2.1% (annualized Q4 2024) | Slower growth expected. Risk of recession ~40–50% (Summers warns of possible recession with 2 million jobs lost). |

| Unemployment Rate | 3.7% (late 2024) | Potential rise if companies cut jobs to offset costs. Could increase by 1-2% in severe scenario (millions of jobs at stake). |

Sources: U.S. Bureau of Labor Statistics (inflation, unemployment), Federal Reserve reports, news analysis.

The economic indicators show a picture of concern – higher tariffs likely mean higher inflation and interest rates, with a risk of slowing growth. Now, let’s consider the student debt side:

Table 2: U.S. Student Loan Debt Snapshot (2024-2025)

| Metric | Federal Student Loans | Private Student Loans |

|---|---|---|

| Outstanding Debt Balance | $1.693 trillion (92.2% of total) | ~$138.5 billion (7.8% of total) |

| Number of Borrowers | ~42.7 million (with federal loan debt) | Millions (exact count not officially tracked, many borrowers have both federal and private loans) |

| Average Balance per Borrower | ~$38,300 (federal only) | Often higher for those who exhausted federal limits; average total student debt (including private) ~$41,600 |

| Typical Interest Rates (2025) | 4.99%–7.54% (fixed, for new federal loans by law) | ~4%–14% (variable or fixed, credit-based)¹ |

| Protections and Relief Options | Income-driven plans, public service forgiveness, deferment, forbearance, discharge on death/disability, etc. | Very limited: typically forbearance (interest accrues), sometimes modification. No standard income-based plans or forgiveness programs. |

| Default Rate | 4.86% (of loan dollars in default as of 2024 Q4) | 1.61% (of loan dollars in default as of 2024 Q1) |

| Co-signer Requirement | Not applicable (loans are government-backed) | Common – ~90% of private undergraduate loans are co-signed. |

¹ Private loan interest rates vary widely based on the lender and borrower credit. Many private loans taken out in the past decade carry fixed rates between ~6% and 12%, or variable rates (currently trending upward as the Fed raises rates). High-credit borrowers could get rates comparable to federal in some cases, whereas others pay much more.

² Private loan default rates might appear lower in part because private loans often go to borrowers with stronger credit or co-signers, and lenders can sometimes restructure or charge off loans before classifying as “default”. Also, federal default rates surged before the pandemic, whereas many private loans were being actively collected or refinanced.

These numbers reinforce the point that private student loans are a smaller but significant portion of the debt landscape. And unlike the federal side, which enjoys fixed terms set by Congress, the private side is subject to market forces (interest rates, credit conditions) and the lender’s discretion on relief. With economic conditions tightening, private loan borrowers don’t have much cushion.

Navigating Private Student Loan Relief Options

Facing this convergence of high tariffs, rising costs, and stricter loan terms, what can borrowers do? Here we focus on private student loan relief – which encompasses various strategies to manage or reduce the burden of private loans. It’s important to approach this proactively; waiting until you’re in financial distress can limit your options. Here are some key avenues and considerations:

1. Communicate with Your Lender Early

If you anticipate difficulty in making your private loan payments because of increased expenses or other financial changes, reach out to your lender or loan servicer as soon as possible. Many private lenders have some hardship options, even if they’re not advertised as openly as federal programs. These may include:

Short-term forbearance or deferment: Lenders might allow you to pause payments for a few months during a documented hardship (unemployment, medical issues, etc.). Keep in mind interest usually continues to accrue, which can increase your balance. Still, this can provide temporary relief if you need breathing room. Always ask how interest will be handled and if there are fees for forbearance.

Interest-only payments: Rather than full forbearance, some lenders might let you pay just the interest for a limited time. This keeps the loan from growing while lowering your monthly payment significantly. It’s a way to stay current on the loan at a reduced cost until you get back on your feet.

Hardship modification: In rarer cases, a lender may agree to modify the terms of the loan – for instance, extending the repayment term to reduce monthly payments, or even temporarily reducing the interest rate. There’s no guarantee your lender will offer this, but it doesn’t hurt to inquire if you’re truly struggling. They may require proof of hardship (like income loss).

The key is not to assume you have no options. Politely explain your situation – for example, “My expenses have risen due to inflation and I’m between jobs, making it hard to afford my full payment. What options do I have to avoid falling behind?” Lenders often prefer to get something rather than nothing and may work with you. However, remember that any such relief is typically temporary. It’s a band-aid, not a cure.

2. Consider Refinancing (Carefully)

Refinancing means taking out a new loan (ideally at a lower interest rate or better terms) to pay off existing student loans. This can be a useful strategy if you have high-interest private loans and you qualify for a new loan at a lower rate. By refinancing, you might secure a lower monthly payment or save on interest over the long run.

However, in the current climate, refinancing needs to be approached with caution:

Interest rates are higher now: As noted earlier, market rates have gone up. If you last took out a loan a few years ago when rates were lower, refinancing now could actually increase your rate unless your credit improved dramatically. Check current offers from multiple refinance lenders to see if you can meaningfully beat your existing rate. As of early 2025, many well-qualified borrowers are seeing refinance offers in the 5-8% APR range for fixed rates, and somewhat lower for variable – but those variable rates can climb further if the Fed hikes rates again. Make sure any potential savings are worth it.

Extend term vs. lower rate trade-off: You can often reduce payments by extending the loan term (say, from 10 years to 15 or 20 years), but this usually means paying more interest overall. It might be worth it for immediate relief, but be aware of the long-term cost. Use a refinance calculator to run the numbers.

Only refinance federal loans if you’re sure: This article is about private loan relief, but if you also have federal loans, think twice about refinancing them into a private loan. Refinancing federal loans with a private lender turns them into private loans, meaning you lose all federal benefits (income-driven plans, forgiveness options, etc.). It generally only makes sense to refinance federal loans if you have a stable income, don’t plan to use those federal programs, and can get a significantly lower rate. Otherwise, focus on refinancing private-to-private loans.

Locking a fixed rate: If you currently have a variable-rate private loan, refinancing into a fixed-rate loan could protect you from future rate increases. This might be wise if you expect rates to continue rising or if you just want the certainty of a fixed payment. Even if the fixed rate is slightly higher today than your variable rate, it might save you money in the long run if your variable rate would have climbed a lot. Essentially, refinancing can also be a defensive move against inflation and rate hikes.

Before refinancing, get quotes (which usually involve a soft credit check) from a few lenders. Pay attention not just to the interest rate, but also any origination fees or conditions. And ensure you refinance into a loan with no prepayment penalties, so you maintain the flexibility to pay it off faster if you can.

3. Debt Validation and Settlement – Professional Relief Services

If you are overwhelmed by private student loan debt and struggling to see a path forward, you might consider seeking help from professionals who specialize in debt relief for private student loans. One effective approach that has gained traction is debt validation.

Debt validation is a process often used in dealing with debt collectors, where the debtor exercises their right under the Fair Debt Collection Practices Act (FDCPA) to request proof that the debt is legitimate, that the collector has the right to collect it, and that the amount is accurate. Why is this relevant to private student loans? Many private loans, especially those that have been sold or turned over to collection agencies, may lack proper documentation or have errors in their paperwork trail. In some cases, lenders might not be able to produce the original promissory note or a chain of title proving who owns the debt. If they cannot validate the debt, they may have to cease collection efforts. This can potentially lead to a negotiation where the borrower settles the debt for a significantly reduced amount, or the debt might even be dismissed by a court. It’s a complex area, but it has provided relief to certain borrowers who had old or mishandled private loans.

Private Student Relief is an example of a company specializing in this niche. With over 8 years of experience offering debt validation services for private student loans, they help borrowers challenge the validity of their private loan debts and negotiate with creditors. The process typically involves a thorough audit of the loan’s history, preparing legal correspondence to request validation, and leveraging consumer protection laws. The goal is to either prove the debt can’t be enforced or to push the creditor into a settlement that dramatically reduces the balance. This kind of service can be invaluable if you suspect something is amiss with your loan or if you’re being hounded by collectors on a defaulted private loan. It’s worth noting that debt validation isn’t about avoiding true obligations – it’s about making sure the lender or collector is playing by the rules and can legally prove you owe what they claim.

Beyond validation, there are also debt settlement companies and attorneys who can negotiate directly with lenders on your behalf. If you have a lump sum available (for example, from a family member, or a bonus, etc.), sometimes a private lender will accept less than the full balance as a settlement. Some borrowers have reported settling private student loans for 50 cents on the dollar (or even less) especially if the loan was already in default. Every situation is unique, so results vary. These approaches do typically impact your credit score (settling for less than owed will be noted on your credit report), but if you’re in dire straits, the credit hit might be worth the financial relief.

Warning: If you pursue any form of debt relief assistance, be careful to work with reputable organizations. Unfortunately, the student loan world has seen scams and unscrupulous actors. Avoid any company that guarantees total loan forgiveness or asks for large upfront fees. Legitimate companies will be transparent about their fees and usually charge only for results (or on a reasonable monthly or project basis). The fact that Private Student Relief has been in business for 8+ years is a good sign, as many fly-by-night operations don’t last that long. Check reviews and, if possible, get a free consultation first.

4. Budget Adjustment and Income Boosting

While seeking private student loan relief through external means, don’t overlook steps you can take personally in response to the changing economy:

Adjust your budget: It might sound obvious, but during periods of high inflation, revisit your monthly budget line by line. Look for non-essential areas to cut back, at least temporarily, to free up funds for your student loan payments. Perhaps dining out or entertainment spending can be trimmed until things stabilize. Every dollar saved can help avoid going deeper into debt or missing payments. The goal is to offset those higher grocery and gas bills caused by tariffs with cuts elsewhere.

Increase income if possible: In a tight labor market (even if slowing, unemployment is still relatively low), consider side gigs or freelance work to bring in extra cash that can be earmarked for loan payments. Gig economy jobs, tutoring, consulting in your field, or even selling unused items can generate incremental income. It might not be sustainable long-term if you’re already busy, but short-term it could help you through a rough patch.

Utilize grace periods or employer assistance: If you’ve recently graduated, remember that many private loans still have a grace period (often 6 months) before you must start paying. Use that time wisely to build an emergency fund or start paying interest so it doesn’t capitalize. Additionally, check if your employer offers any student loan assistance benefits – a growing number of companies do, and even $50 or $100 a month from them can make a dent over time.

The overarching theme here is proactivity. Economic challenges like a trade war fallout are largely out of our individual control. What we can control is how we respond. By seeking relief options, communicating with lenders, and possibly restructuring our finances, we can better weather the storm.

5. Special Consideration: Professionals (e.g., Physicians) with Private Loans

It’s worth noting that private student loan burdens are not only an issue for undergraduate borrowers or those with low incomes. Even high-earning professionals such as doctors can find themselves seeking relief. Medical school is extremely costly, and while many medical students use federal loans, some also rely on private loans (especially for residency relocation, board exams, or if they hit federal caps). Additionally, some physicians refinance their federal loans with private lenders to get a lower interest rate once they have a good income. This means they forego federal protections, and if circumstances change, they might need help.

For example, a physician might have refinanced $200,000 of federal loans into a private loan for a lower rate. That’s great until a scenario where perhaps their income drops (think of a surgeon who can’t work for months due to an injury, or an economic downturn reducing elective procedures). Suddenly, that large loan with no income-based plan becomes a serious strain. Debt relief on private student loans for physicians is actually a niche topic in personal finance – it underscores that high income doesn’t always equate to invulnerability. Big debts require big payments, and if income falters or expenses rise, even a doctor can struggle. The strategies discussed – refinancing (if rates drop again), negotiating hardship plans, or seeking professional debt relief assistance – apply to them as well. In fact, physicians often have more to lose (credit damage or default could threaten professional licensing in extreme cases). So if you’re a professional with substantial private loan debt, don’t hesitate to seek relief options just because you have a good salary on paper. Economic shifts like a tariff-induced downturn can affect everyone.

FAQ: Frequently Asked Questions

Q1: What exactly are the new 125% tariffs on China, and why were they implemented?

A: The 125% tariffs are an import tax that the U.S. government has placed on goods coming from China. In practical terms, for every $100 of a Chinese product, importers must pay $125 in tariff duties – more than doubling the cost. These tariffs were implemented in early 2025 as part of an escalating trade war. The U.S. imposed them after China retaliated against earlier U.S. tariffs. Officials claim the tariffs are meant to pressure China to change certain trade practices and address the trade imbalance. However, this is a very steep tariff rate (far above the 10-25% rates seen in earlier trade disputes), and it has prompted concerns about higher consumer prices and strained supply chains. It’s a drastic measure reflecting heated trade negotiations.

Q2: How do these tariffs impact the U.S. economy overall?

A: The tariffs act like a tax on U.S. consumers and businesses. In the short term, they are likely to raise prices (inflation) on many goods. We can expect items imported from China – electronics, appliances, furniture, clothing, and more – to become more expensive. American companies that rely on Chinese components also face higher costs, which can reduce their profit margins or lead them to increase their own prices. Additionally, trading partners can retaliate (China can impose tariffs on U.S. exports, making it harder for American farmers and manufacturers to sell in China). The Federal Reserve has indicated this could cause at least a temporary rise in inflation. If inflation rises too much, it could slow consumer spending since people can afford less. Businesses might scale back expansion plans due to cost uncertainties. Analysts like Larry Summers even warn that continued trade tensions at this level could tip the economy into a mild recession, with job losses potentially reaching into the millions if companies react by cutting payroll. In summary, the tariffs create headwinds for economic growth and pose a balancing act for policymakers trying to maintain stability.

Q3: Why should student loan borrowers care about tariffs or inflation – isn’t that unrelated to my loans?

A: It might not seem obvious, but tariffs and the broader economy have a direct impact on your personal finances and your ability to manage student loans. Here’s why: tariffs can fuel inflation, meaning you pay more for goods and services. If your rent, groceries, utilities, and other expenses go up, you have less disposable income to put toward loan payments – this makes it harder to stay on top of debt. Inflation also often leads to higher interest rates (the Federal Reserve may hike rates to combat rising prices). Higher interest rates translate to more interest on credit cards, mortgages, and yes, private student loans (especially if you have a variable rate). So new loans or refinanced loans might come at a higher cost. Finally, if tariffs slow down the economy or cause job losses, borrowers could face unemployment or reduced income, making it challenging to pay any bills, including student loans. In short, a shaky economy can strain household finances from multiple angles, so borrowers should absolutely care. It’s all interconnected – the more the economy affects your wallet, the more it affects your loan repayment.

Q4: What is “private student loan relief” exactly?

A: “Private student loan relief” is a broad term that refers to any strategy or program that helps reduce the burden of private student loans. Because private loans are issued by private lenders, there isn’t a single government-sanctioned relief program for them (unlike federal loans which have things like Public Service Loan Forgiveness or income-driven repayment plans). So, private loan relief can take several forms:

It could mean refinancing the loan to get a lower interest rate or better terms.

It could involve working with the lender on a modified payment plan or a temporary hardship forbearance if you hit tough times.

It might entail debt settlement or negotiation, where you arrange to pay less than you owe (often with help from a debt relief company or attorney).

It can also include debt validation strategies where the legal enforceability of the loan is challenged (as discussed earlier).

Some people also lump in any private initiatives, like a lender’s own relief program (for example, a few lenders offered limited relief during COVID for private loan holders, like pausing payments for a couple of months). Essentially, private student loan relief is about finding ways to either lower the amount you have to pay, lower your interest, or extend the time you have to pay so that the loans become more manageable. Since there’s no one-size-fits-all solution, it often requires individual research or partnering with a company that specializes in helping borrowers with these loans.

Q5: How can I tell if I should refinance my private student loans in the current economy?

A: Start by evaluating your current loan details and your financial profile. Ask yourself: What interest rate am I paying now, and is it fixed or variable? How is my credit score today compared to when I originally took the loan? Do I have stable income and a good debt-to-income ratio? If your current rate is high (for instance, 10%+) and you see that refinance offers for someone with your credit are significantly lower, it might make sense to refinance, even if overall market rates have risen from a couple of years ago. However, if you already have a relatively low rate, refinancing during an inflationary period when rates are up could backfire – you might end up with a higher rate. Also consider the remaining term on your loan. If you’re close to paying it off, refinancing may not be worth the hassle or any fees. On the other hand, if you have many years left, even a small rate reduction could save you a lot. One savvy move can be to check with a credit union or smaller bank, as they sometimes have special refinance deals. And remember, if you have multiple loans, you can choose to refinance some or all of them. In this economy, the general advice is: only refinance if you can meaningfully reduce your interest rate or monthly payment (without excessively extending your term, unless you absolutely need to). It’s always a good idea to use a refinancing calculator to plug in the numbers and see the potential savings. And if you’re unsure, consult a financial advisor or a student loan counselor who can give personalized guidance.

Q6: I’ve heard of debt validation and debt relief companies – can they really help with private student loans?

A: They can, but results vary case by case. Debt validation, as mentioned, leverages your right to demand proof from a debt collector that a debt is legitimate. Some specialized companies (like Private Student Relief) focus on private student loans that are in default or collections. They will communicate with your loan holder or collector to request all the documentation. In some instances, especially if your loan changed hands or has some legal technicality, the collector might fail to produce the proper proof, which strengthens your position to negotiate a reduction or cancellation. Debt relief companies might also negotiate a settlement – for example, getting the lender to accept, say, 50% of the loan balance as payment in full, often paid in a lump sum or short-term installments. These things do happen, and borrowers have saved money through them. However, it’s not guaranteed – if your lender has all the paperwork in order and you have a steady income, they may be less inclined to settle for less. Also, engaging in these processes can impact your credit (since typically you’d stop paying during negotiations, leading to delinquency or a noted settlement on your credit report). It’s a route more suitable for those who are already in deep distress with their loans or those who have tried other options without success. If you go this route, make sure to work with a reputable firm. Look for transparent fees (avoid big upfront fees), good reviews, and ideally a company that has attorneys or legal experts on staff because private student loan issues can involve legal nuances. Many will offer a free consultation – take advantage of that to ask what realistic outcome they can achieve for you.

Q7: Is private student loan relief available for professionals like doctors or lawyers?

A: Yes – relief options for private loans are available regardless of your profession. There’s nothing formally different about a physician’s private loan versus anyone else’s; it’s more about the amount and terms. In fact, as we discussed, physicians often have large private loans (either from refinancing or supplements to med school financing) and may seek relief if they run into financial challenges. Being a high-income professional might actually give you more refinancing options (because lenders love a stable, high income for approving low-rate refis), so that’s one avenue. But if a physician or lawyer is struggling – say, due to a costly life event or a dip in income – they can absolutely look into the same relief strategies: negotiate with the lender, refinance, or hire a debt relief service. The key difference is that some professionals might feel stigma about seeking help since they’re “supposed” to be well-off. It’s important to break that stigma – these economic forces can hit anyone. Debt is debt, and if you need help, you pursue it. Some companies even specialize in advising professionals; for example, there are financial planners who cater to physicians’ student loan strategies (especially given the mix of federal and private loans many doctors have). So, in summary, yes, private loan relief is for anyone who needs it – being a doctor, lawyer, MBA, etc., just means you might have a bigger balance to deal with, but you also might have more resources to deploy. Don’t hesitate to explore your options.

Q8: How does Private Student Relief (the company) assist borrowers, and is it trustworthy?

A: Private Student Relief is a company dedicated to helping borrowers reduce and resolve their private student loan debt. They have over 8 years of experience in this field (which is relatively long in the niche world of student loan relief). Their services typically revolve around the debt validation and negotiation approach we discussed. They will review your loan details, gather information, and then reach out to your lender or collection agency on your behalf to challenge the debt or negotiate new terms. The goal might be to invalidate the debt (if errors are found) or to settle it for less, or to get you on a more affordable payment plan. They essentially act as an advocate and intermediary, armed with legal and financial expertise. As for trustworthiness, longevity is a good sign – 8 years in business suggests they are not a scam (most scams in this arena get shut down quickly by regulators). It’s always wise, though, to do your own due diligence: read client testimonials, check if they have any BBB (Better Business Bureau) complaints, and make sure you fully understand their fee structure before signing up. A legitimate company will usually charge fees that are proportionate to the help they provide (for example, a flat fee or a percentage of how much debt they reduced for you). If you’re drowning in private loan debt and nothing you do seems to make progress, a company like Private Student Relief could be worth a try. Many people have seen substantial relief through such services – just go in with realistic expectations and ensure you’re working with a reputable team.

Conclusion: Turning Challenges into Action

The new 125% tariffs on China have introduced a wave of economic uncertainty – from higher prices at the store to potential tremors in the job market. For borrowers already carrying the weight of student loans, especially private student loans, these developments can feel like piling on additional weight when you’re already climbing uphill. We’ve explored how these tariffs might drive up inflation, nudge interest rates higher, and even threaten growth, all of which funnel down to individual finances.

Key takeaways: Borrowers with private student loan debt are indeed vulnerable to such economic shifts. They generally lack the robust safety nets that federal loan borrowers have, meaning they feel the pain of a dollar that doesn’t stretch as far or an interest rate that keeps inching up. However, this doesn’t mean all is bleak. By understanding the landscape and taking proactive steps, you can navigate through the storm. Whether it’s tightening your budget, refinancing strategically, or leveraging private student loan relief programs, there are avenues to explore rather than letting the situation control you.

One recurring theme is the importance of seeking help and information. If you’re struggling, reach out – to your lender, to financial counselors, or to specialized companies like Private Student Relief. With their 8+ years of experience in debt validation and negotiation, they have helped many borrowers find a path out of what seemed like an impossible situation. Sometimes a professional hand can open doors (or cut through red tape) that you alone could not.

Finally, remember that economic cycles come and go. Tariffs may rise and fall, inflation will eventually stabilize, and policies will adjust. Your goal as a borrower is to build resilience. That might mean restructuring your debt, building an emergency fund, or getting expert help to fortify your finances. By reading this comprehensive overview, you’ve already taken an important step: educating yourself. Now, use this knowledge to act. If private student loan debt is a heavy burden on your shoulders, consider reaching out to Private Student Relief or similar services for a personalized plan of attack. With the right strategy and support, you can lighten that burden and secure your financial future, tariffs or no tariffs.

Don’t let your private student loans hold you back, especially in these challenging economic times. If you’re seeking relief and a way to regain control of your finances, contact Private Student Relief today. With over 8 years of specialized experience, they offer a free initial consultation to evaluate your situation and discuss how debt validation or other relief programs could help you. It’s time to take charge of your debt and move toward financial freedom – and you don’t have to do it alone. Reach out to Private Student Relief and explore your options for real, lasting private student loan relief.