Are you a physician in the United States struggling to manage private student loans? In this article, we will explore options and strategies for private student loan relief tailored specifically for medical professionals. Additionally, we’ll explain how our service at Private Student Relief, with over 8 years of experience, can help validate your debts and provide customized solutions.

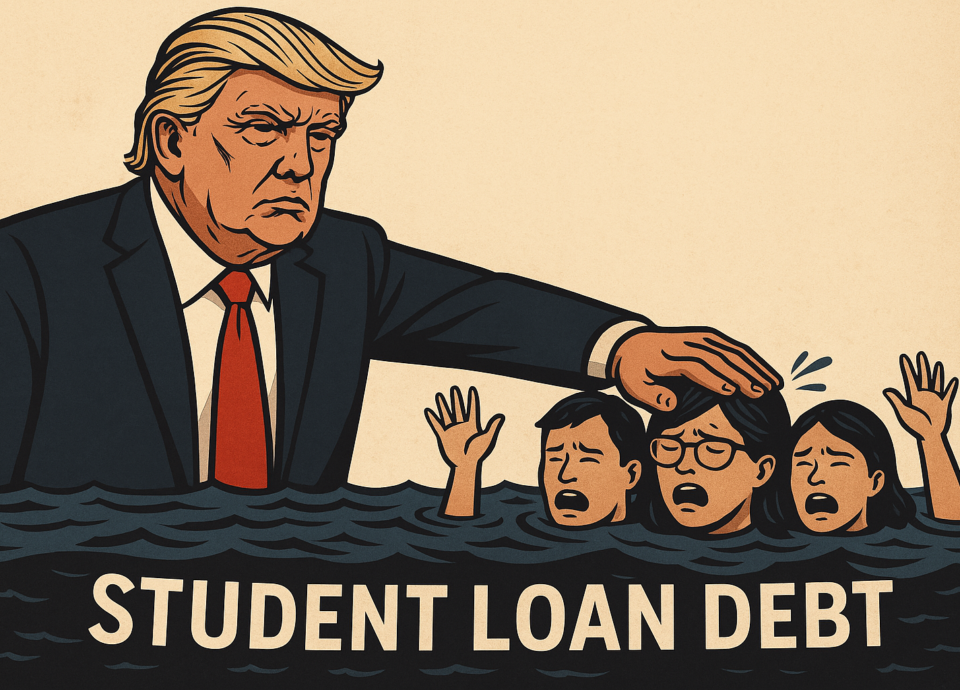

The Burden of Private Student Loans for Physicians

Medical professionals often graduate with substantial debt due to the high costs of medical school, averaging over $200,000. While federal student loans offer a variety of relief programs, private loans lack these benefits, making repayment more challenging.

However, there are ways to manage and reduce this burden through private student loan relief strategies. These include negotiating with lenders, restructuring payments, and debt validation. Here, we’ll break down everything you need to know.

What Is Private Student Loan Relief for Physicians?

Definition and Key Benefits

Private student loan relief refers to strategies for reducing, renegotiating, or effectively managing private student loan debt. Unlike federal loans, private loans do not offer standard forgiveness programs, making it critical to explore alternative solutions, such as:

- Direct negotiation with lenders: Reducing interest rates or adjusting payment plans.

- Debt validation: Ensuring the debt is legitimate and complies with regulations.

- Consolidation or refinancing: Securing better terms to lower monthly payments.

At Private Student Relief, we specialize in validating private student loan debts, ensuring they comply with financial laws. This process can uncover errors that work in your favor.

Why Do Physicians Need Help with Private Student Loans?

Unique Challenges Faced by Physicians

- High debt amounts: Many physicians graduate with over $300,000 in debt, particularly from private institutions.

- Elevated interest rates: Private loans often have variable rates that increase over time.

- Limited options: Physicians are ineligible for programs like Public Service Loan Forgiveness (PSLF).

Solution: Our validation service at Private Student Relief examines the terms of your loan to identify irregularities and help you renegotiate better terms.

Options for Private Student Loan Relief for Physicians

Effective Strategies to Reduce Financial Stress

1. Debt Validation

At Private Student Relief, we verify the legitimacy of your private student loans. This includes analyzing legal documents and contracts to identify errors, which can lead to:

- Partial or full cancellation of the loan.

- Reduction of unfair interest rates.

2. Refinancing

If you have a strong credit history, consolidating multiple private loans into one with a lower interest rate can simplify your payments.

3. Lender Negotiation

With our expertise, we can help you negotiate directly with your lender to modify loan terms and lower monthly payments.

Why Choose Private Student Relief?

Experience and Proven Results

- Over 8 years of expertise: We’ve helped hundreds of physicians reduce their financial burdens.

- Personalized approach: Every case is unique, and we tailor strategies to fit your situation.

- Professional team: Our experts specialize in financial law and lender negotiations.

What Does Our Debt Validation Service Include?

- Comprehensive review of loan agreements.

- Identification of potential errors or legal violations.

- Detailed report with actionable recommendations.

Frequently Asked Questions (FAQs)

What’s the difference between federal and private loans?

Federal loans offer benefits like forgiveness programs and income-driven repayment plans, while private loans depend entirely on the lender’s terms.

Can I reduce the interest rate on my private loan?

Yes, refinancing or negotiating with your lender can secure lower interest rates if you have a strong credit history.

How much does debt validation cost?

Costs vary depending on the complexity of the case. At Private Student Relief, we offer an initial free consultation.

Can I combine all my private loans into one?

Yes, through consolidation or refinancing, you can simplify your loans into a single payment.

Is debt validation legal?

Absolutely. Debt validation is a consumer right and can uncover errors or irregularities in loan agreements.

Conclusion: Take Control of Your Debt with Private Student Relief

As a physician, your focus should be on saving lives, not on the stress of managing private student loans. At Private Student Relief, we understand the unique challenges you face and are here to provide proven, customized solutions.

Contact us today for a free consultation and start your journey to financial relief with experts in private student loan relief.