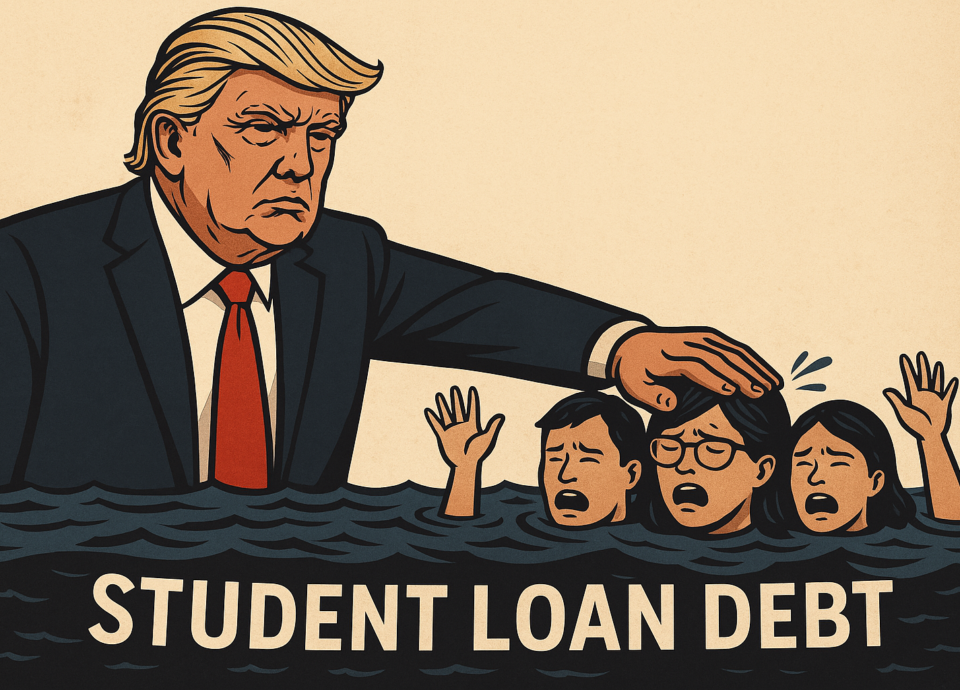

In the United States, many people face the challenge of paying off private student loans. Unlike federal loans, these do not offer extensive relief options or benefits like forgiveness programs. This is where private student loan relief programs play a crucial role. In this article, we’ll explore available options, how debt validation works, and why Private Student Relief, with over 9 years of experience, is your best ally.

What Are Private Student Loan Relief Programs?

Private student loan relief programs are services designed to help borrowers manage or reduce their financial obligations. While they don’t directly eliminate debt, they can offer legal and effective strategies such as:

- Payment negotiation: Reducing monthly burdens.

- Debt validation: Ensuring the legality and accuracy of the loan.

- Term renegotiation: Changing unfavorable loan conditions.

The key to achieving positive outcomes lies in working with experts who understand the legal and financial complexities of private loans.

How Does Debt Validation Work?

Debt validation is a legal process that ensures:

- The creditor has the right to collect the debt.

- Loan terms are accurate.

- There are no errors or illegal overcharges in the balance.

At Private Student Relief, we conduct a detailed analysis of your private student loan to identify potential discrepancies. If we find inconsistencies, we can help reduce or even invalidate your debt.

Advantages of Debt Validation

Choosing this service offers tangible benefits such as:

- Financial transparency: Knowing exactly what you owe and to whom.

- Legal protection: Avoiding unjust payments.

- Debt reduction: Eliminating invalid amounts in some cases.

Comparing Private vs. Federal Student Loans

It’s important to understand the key differences:

| Feature | Federal Loans | Private Loans |

|---|---|---|

| Relief programs | Extensive | Limited |

| Forgiveness options | Available | Nonexistent |

| Payment flexibility | High | Low |

| Interest rates | Fixed and low | Variable and high |

Private loans require specialized solutions, like those we offer at Private Student Relief.

How to Find Reliable Debt Relief Programs

With so many options on the market, choosing a trustworthy service can be challenging. Follow these tips:

- Research the company’s reputation. Look for reviews and testimonials.

- Avoid unrealistic promises. No program can guarantee total debt elimination.

- Inquire about specific services, such as debt validation.

Why Choose Private Student Relief

With over 9 years of experience, Private Student Relief specializes in private student loan relief. Our team offers:

- Detailed debt analysis.

- Personalized legal strategies.

- Proven results.

Our exclusive approach ensures every client receives a plan tailored to their needs.

FAQs

1. What is a private student loan?

It is a type of educational financing provided by banks or other private entities, with less flexible terms than federal loans.

2. Does debt validation guarantee I won’t have to pay?

No, but it can identify errors or unjust charges that may reduce your debt.

3. How much does this service cost?

The cost varies depending on the complexity of the case. Contact us for a personalized consultation.

4. Can you help with federal loans?

We specialize exclusively in private student loans.

5. How do I start the process with Private Student Relief?

Complete our online form, and an advisor will reach out to you.

Conclusion

Facing private student loan debt can be overwhelming, but you’re not alone. With the help of experts at Private Student Relief, you can explore legal and effective solutions like debt validation. With over 9 years of experience, we are committed to helping you regain financial control.

Don’t wait any longer! Contact us today and discover how we can assist you on your journey to financial freedom.